The number of organizational leaders finding themselves in this predicament is magnified with each technology, market trend and new entrant emerging on the scene, combined with shifting customer expectations and needs. After having strategic conversations with key automotive players across the globe, one good thing becomes clear – the opportunity to define a new model for customer experience, loyalty and value for OEMs and NSCs is there and it is achievable. But they need to start now...

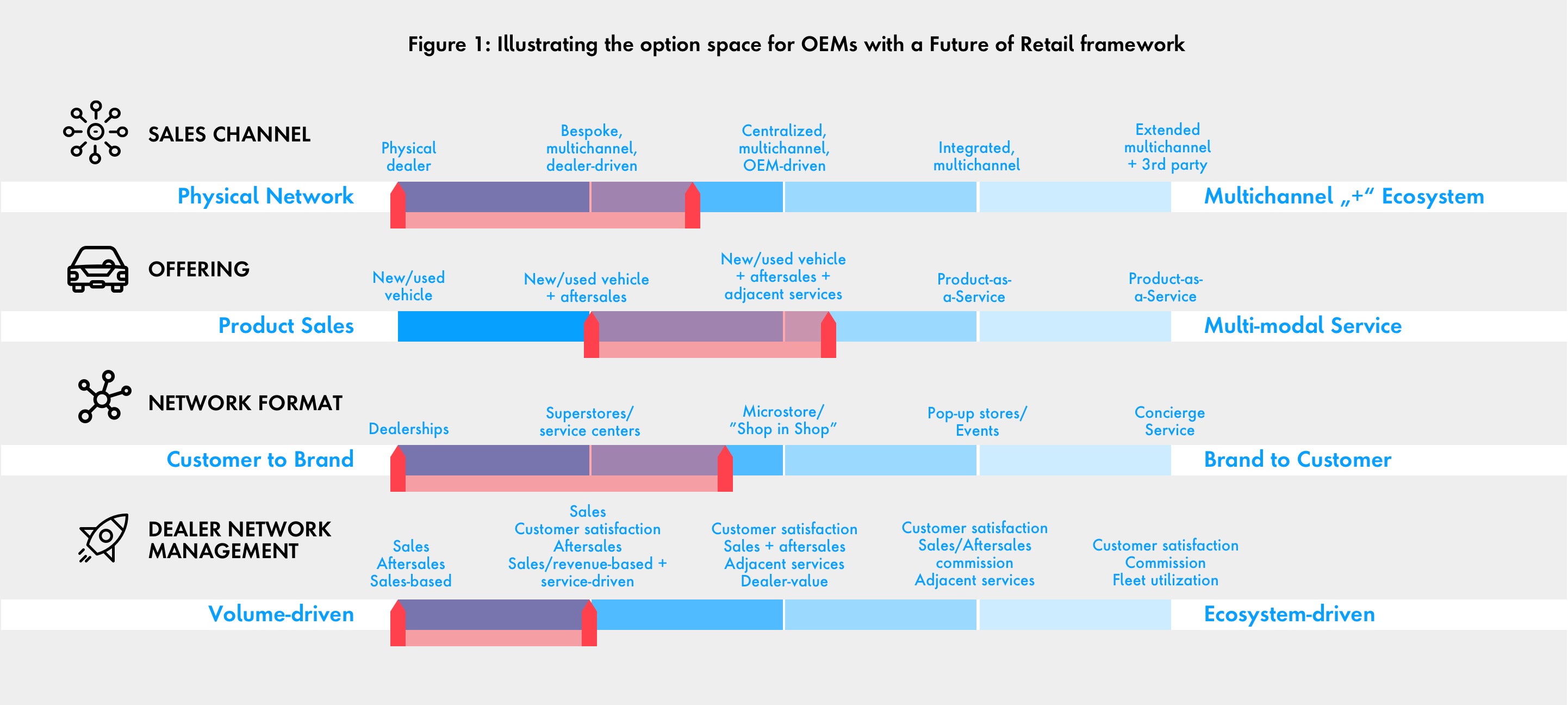

How to model the future of automotive retail

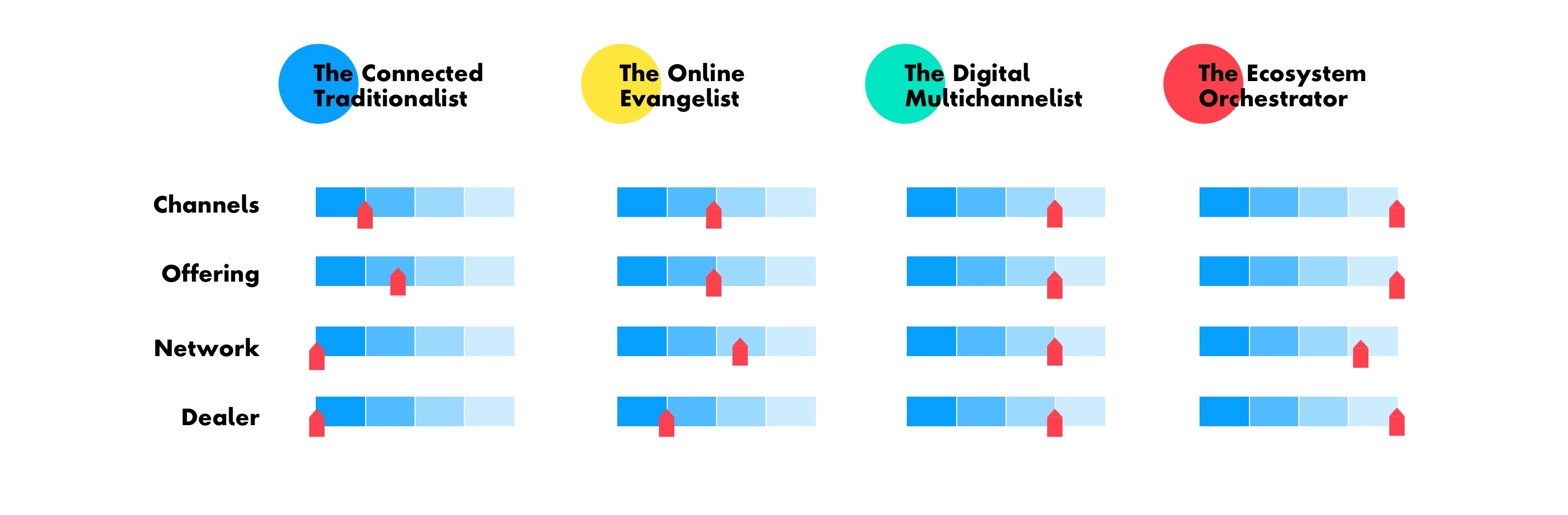

Many of an OEM’s or NSC’s traditional practices are now in a state of flux. New ownership models are already in their pilot phases, market dynamics are driving new ways of partnering, complex autonomous driving solutions are being developed for long-term impact and significant investments are being made into e-mobility. This dynamic environment has given rise to four distinct phenotypes across the transportation and mobility sector: