The Hybrid Solution, Reimagined

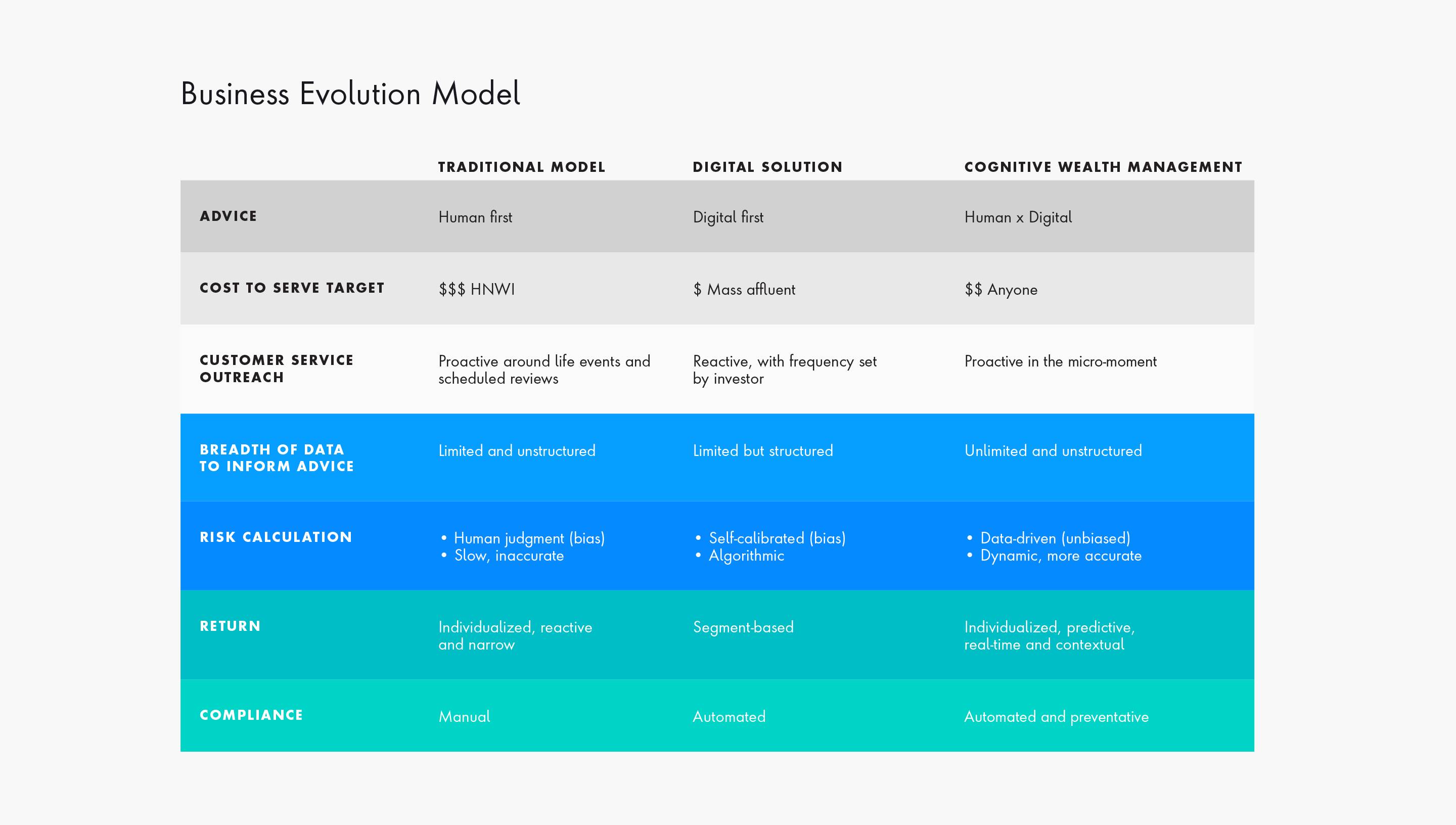

Given these findings, it’s perhaps unsurprising that many financial services organizations have reaffirmed the need for human oversight, even as the world continues to reach new levels of digitization. In fact, just one year after issuing its $8T forecast, BI Intelligence released a follow up report, revising the forecasted figure for assets under management by roboadvisors to just $1T by 2020. So too are they realizing that the hybrid model—a wealth management approach that combines digital technology and human touch—is both outdated and inadequate. Instead, there is a need for financial institutions to refine this model and look to the opportunity that deeper, more advanced application of AI presents.

A recent report published by ESI Thoughtlab confirms that the use of AI is still in its infancy among wealth and asset management firms. At present, most organizations have only adopted “unintelligent” robotic process automation (RPA), which is largely used to address administrative tasks and improve the productivity of advisors.

However, the power of advanced AI—which includes intelligent process automation, machine learning and deep learning—can go beyond basic automation and perform much more complex tasks, such as accurately tracking market opportunities, anticipating and addressing compliance issues and even identifying new clients.

We call this shift to a deeper, more intelligent use of AI “cognitive wealth management.” Like traditional hybrid models, cognitive wealth management uses AI to provide client-facing tools, such as self-service onboarding, portals and interactive dashboards. However, it also goes deeper, targeting both the operations of the firm and the entire wealth management value chain. By targeting both front- and back-office functions, and also infusing AI within the wealth management process as a whole, this model unlocks new levels of client-centricity, organizational efficiency and cost savings.